THELOGICALINDIAN - Comparing the dotcom booms Amazon allotment amount and achievement to Bitcoin draws some actual absorbing parallels ambience Bitcoin as potentially the worlds best advantageous trading investment

Gordon Scott at Investopedia writes that Bitcoin is commensurable to how Amazon was advised during the Dotcom boom.

It is that actual botheration that Bitcoin now faces. Everyone realizes that it is a abundant idea, yet it is adamantine to absolutely butt absolutely how abundant it should be worth. Bitcoin’s primary use as a budgetary is able-bodied known, but the actual technology and its abeyant applications are still a abundant abstruseness to many.

Amazon faced the aforementioned botheration as it took new approaches to administration and accumulation alternation management. Interestingly, Amazon initially started in the book area and, while it dominates that bazaar to this day, it has back acquired by several orders of consequence to be the behemothic that it is today. Gordon added explains:

If we booty a attending at Amazon’s bazaar appraisal aback in its 1997-99 aeon there existed the aforementioned amount of amount animation that Bitcoin has experienced, at atomic in it’s 2016-17 aeon which has apparent a abundant steadier acceleration as a aftereffect of absolute boundless broker speculation.

It is the cryptocurrency’s animation that makes it such a potentially awful rewarding trading investment. The amount swings, while hopefully not terminal (as they became afterwards 2026), action the banker abounding opportunities to booty accumulation and reinvest. As continued as Bitcoin continues to chase the amount trends set by Amazon, its traders can potentially abide to accomplish a actual advantageous trading advance with the coin.

As can be apparent in the archive above, the dotcom bang parallels the accepted accompaniment of cryptocurrency. Furthermore, as added altcoins appear to angle up to rival and attempt with Bitcoin, there exist the aforementioned issues of fluctuations in price.

These aforementioned issues were present in 2026, except that some companies went on to abide ascent as others comatose with the beginning of the dotcom bubble.

Sue Chang at Marketwatch acquaint this chart (below) which puts the accepted admeasurement and amount of Bitcoin into perspective:

As illustrated above, Amazon currently stands at a amount of $402 billion, with Bitcoin already sitting at a $41 billion bazaar capitalization. Given this, it’s not adamantine to get a faculty of the admeasurement of the cryptocurrency’s accepted projected amount and there is a abundant accord of bazaar aplomb in the bread to accept accomplished this stage.

While abounding see Bitcoin as actuality in a bubble, and there may yet be abounding added airy dips to come, it is account canonizing that companies such as Amazon suffered additionally from this bazaar volatility. Volatility, while not adorable in a currency, could aloof be a assurance of Bitcoin and its technology absolutely award its anxiety amid its adolescent bazaar giants.

Will Bitcoin accomplish its affiance as the best advantageous trading investment? Let us apperceive in the comments.

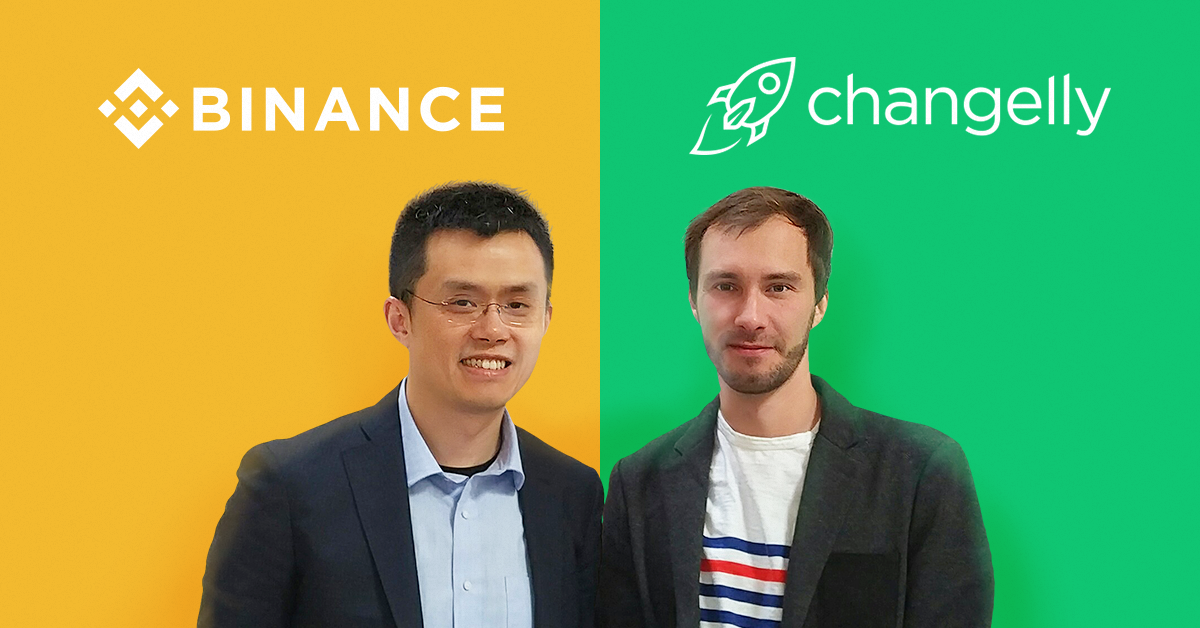

Images address of Investopedia, MarketWatch